Highest-level security

We know that clients care for security of their money and data even more than for low prices. Therefore, we constantly improve and install the newest security systems.

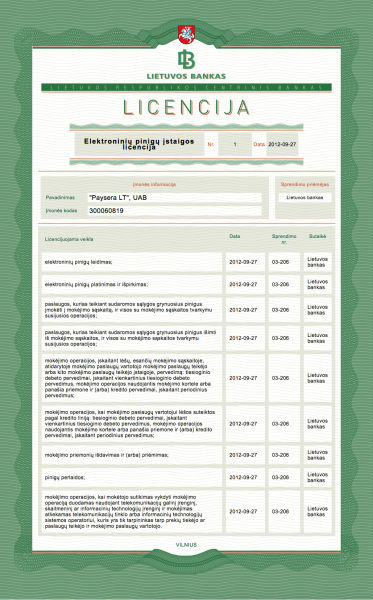

Paysera – the first licensed e-money institution in Lithuania

Special e-money institution licence

Since 2012, Paysera is a licensed e-money institution with the right to execute the activity related to the issuance of e-money and provision of payment services all around the European Union. The e-money institution licence was issued by the Bank of Lithuania.Money is safe

All funds transferred to your Paysera accounts are separated from the funds of the company and cannot be used for company needs, loaned or invested. All money is kept only in reliable credit institutions of the European Union.Supervision of the Bank of Lithuania

The institution is periodically checked and audited by the Bank of Lithuania, which ensures the transparency and impeccable activity of Paysera. Official website of the Bank of Lithuania:www.lb.lt.What is a payment institution

What is a payment institution?

What is a payment institution?