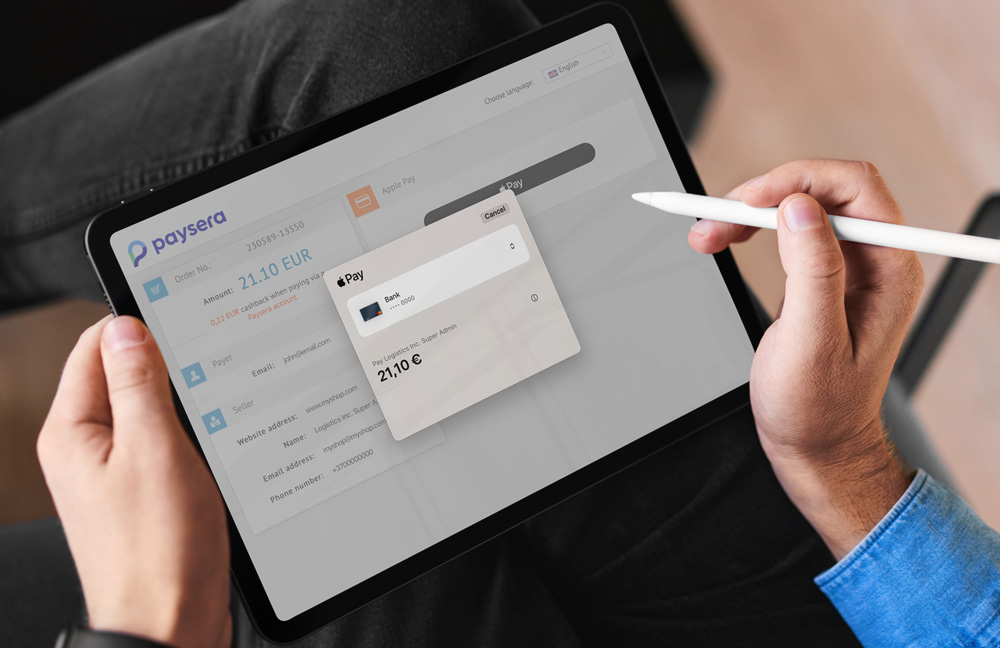

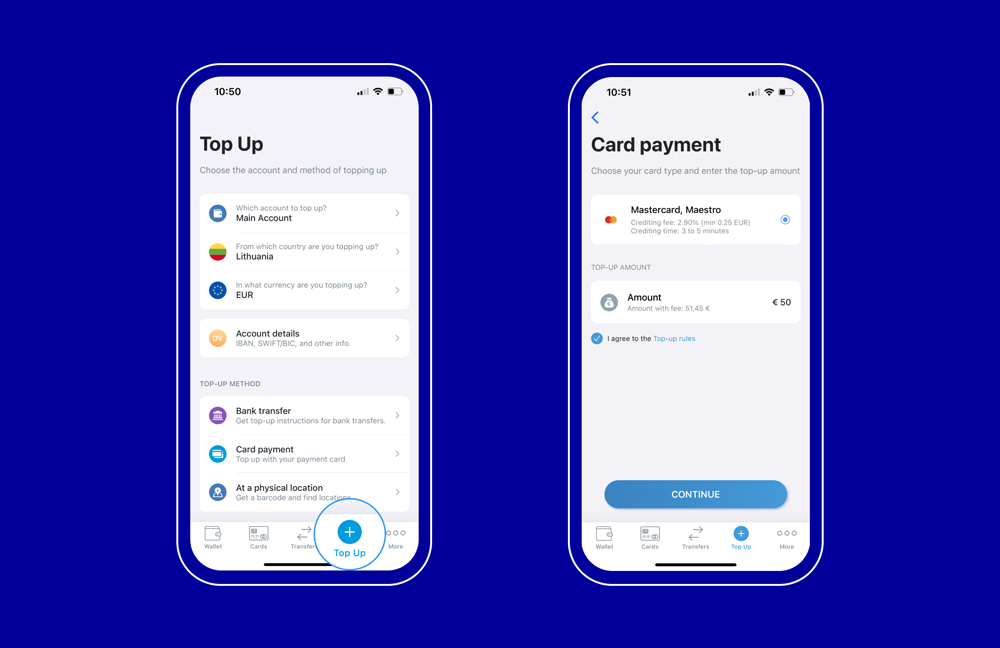

Small businesses have two months to prepare cash registers for data transmission to the State Tax Inspectorate (VMI)

Small businesses are now facing the final two months with cash registers that don't yet transmit data to the State Tax Inspectorate (VMI). Starting 1 May, a new regulation will require businesses to use cash register systems that regularly send data to the VMI. As this deadline draws closer, the financial technology company Paysera is addressing five common myths surrounding the upcoming change.