How to spot and avoid common holiday scams

The holiday season is here and you’re probably excited to share the holiday spirit with the people around you. But while you’re shopping for presents or donating to charities, it’s important to stay alert. Scammers often use the holiday spirit, excitement, or even stress to fool people. To help you protect yourself and your loved ones, we’re sharing practical tips on recognising and avoiding common holiday scams.

Have you heard of the term “social engineering”?

The “engineering” part might make it sound technical, but it’s really about manipulating people, not machines.

Social engineering is when someone tricks you into sharing personal information or doing something you wouldn’t normally do. Scammers use lies, emotional pressure, or manipulation to gain access to money, accounts, or confidential details.

Let’s explore some specific holiday scams so you know how to stay safe.

Different types of delivery scams

With so many gifts to send and receive, it’s hard to keep track of everything and delivery scams are especially common during the holidays.

Here are the most common delivery scams you should watch out for.

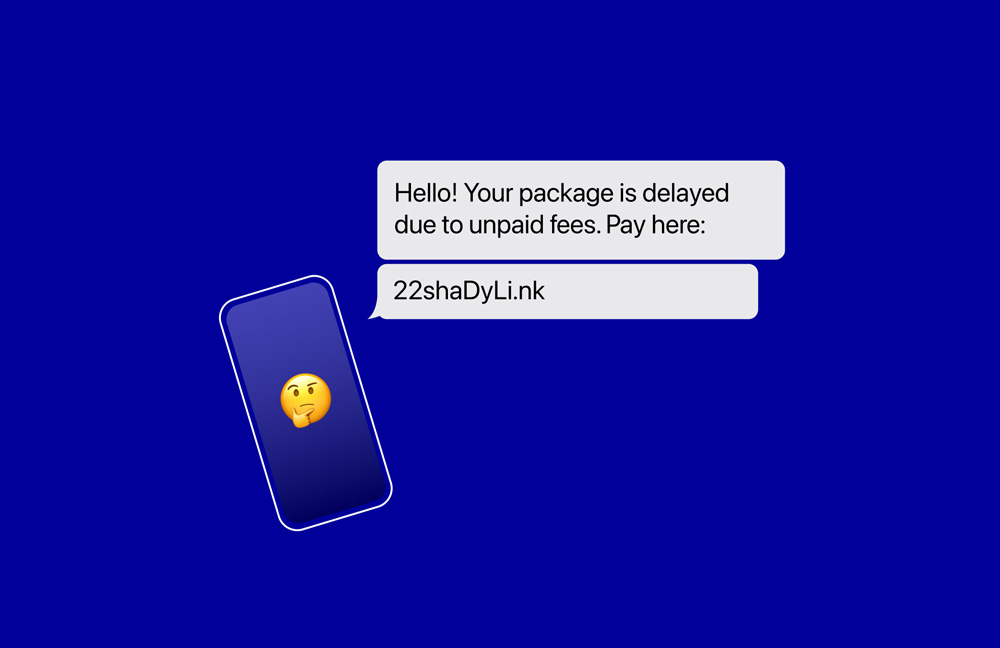

Fake texts and emails claiming to be from delivery companies or local postal services

Messages claiming, “Your package is delayed due to unpaid fees” or “Click this link to reschedule delivery” often lead to fake websites designed to steal your payment or personal details.

Fraudulent ‘customer support’ calls

Scammers may pose as delivery company representatives, claiming there’s an issue with your package and asking for payment information or personal details over the phone.

The "Friend or Relative Sent You a Gift" scam

A scammer might tell you a friend or relative sent you a gift, but you need to pay fees or customs duties before delivery. Unfortunately, once payment is made, the gift never arrives.

Marketplace delivery fraud

On platforms like Facebook Marketplace or eBay, scammers might pose as sellers, requesting payment for shipping but never sending the goods.

How to stay safe

-

Avoid clicking on unexpected links in texts or emails.

-

Verify delivery issues directly with the shipping company using their official website or phone number.

-

Be cautious with marketplace purchases: check seller reviews and use secure payment methods.

Charity scams will try to abuse your kindness

There are cases when fraudsters pose as charitable organisations seeking donations, knowing about the natural tendencies of people to give more to charities during the holiday season.

Our advice is to strong>always research specific charities. Look them up in official databases, review their online presence, and watch out for pressuring language and other suspicious details.

Watch out for fake online stores

Holiday shopping is fun… Until you find out that a certain e-shop is too good to be true.

Fraudulent websites or social media ads sometimes advertise unrealistic deals that are supposedly available on e-shops. After payment, you would either receive counterfeit goods or nothing at all.

Before you enter any personal details and buy from an e-shop, you should:

-

Research the store by checking reviews and confirming contact information.

-

Avoid deals that seem unrealistically cheap.

-

Use secure payment methods, such as credit cards, which offer fraud protection.

If someone asks you to pay with gift cards – be wary

Scammers often target gift cards because they are a quick, untraceable, and irreversible way to steal money. They might attempt to pressure you into making payments with gift cards for fines, overdue bills, or holiday deals, and that alone is a red flag.

Never use gift cards as payment for anything other than intended retail purchases, and report requests for payment via gift cards immediately.

Different types of social media scams

Social media has transformed how we connect with people worldwide, offering countless opportunities for communication and sharing. However, it also comes with risks, including scams that target unsuspecting users. By learning about common social media scams, you can spot warning signs early and protect yourself from fraud.

Impersonation scams

Scammers create fake profiles pretending to be your friends, family, or celebrities to ask for money or personal information.

Romance scams

Romance scams are similar to impersonation scams, except in this case you’ll be contacted by someone you don’t know who is using another person’s photos and information. In this way, fraudsters create fake profiles and develop online relationships to exploit people emotionally and financially.

Giveaways and prize scams

Scammers claim you’ve won a prize or giveaway but need to pay a fee or share personal information to claim it.

Investment scams

Everything looks beautiful and perfect on social media, including financial offers. However, the reality behind offers that are too good to be true is rather different. Fraudulent accounts use social media to promote fake investment opportunities, promising high returns with minimal risk.

Fake loans

Scammers often advertise ‘quick approval’ loans with no credit checks and unrealistically low interest rates. They may ask for upfront fees, claiming they are for processing or insurance.

How to stay safe

The list of these tactics goes on, but as a rule of thumb, remember: if someone’s pressuring you for personal or financial information, or even outright asking for money, it’s a strong signal that scammers are targeting you.

Remember to:

-

Verify profiles and check in with friends or family before sharing money or information.

-

Be sceptical of strangers professing love quickly or asking for money.

-

Avoid offers that sound too good to be true, and consult a trusted financial advisor before making investments.

Don’t let financial scammers ruin your holidays – stay vigilant

If it sounds too good to be true, it probably is. Spending a bit of additional time being careful will save you money and prevent unfortunate situations from happening during the holiday season.

If you suspect that you’ve fallen for scamming tactics, make sure you change your account password and inform the police.